(elrs.kerala.gov.in) Kerala State Government Education Loan Repayment Scheme – Application Process, Last Date – 31st Dec

The state govt. of Kerala has launched one subsidy scheme aimed to provide repayment assistance to those students of Kerala who have taken education loan for their higher studies and are having difficulty in paying them back. Students can register for this scheme through an online portal which has been operational for student’s registration.

Launch Details

The loan repayment scheme dedicated to the students of Kerala, who are not financially sound and are struggling to repay their debts has been launched on 27th Apr 17 in the assembly sessions held in Thiruvananthapuram’s Old Secretariat Complex. The scheme has been launched by the Hon’ble Chief Minister of the state, Shree Pinarayi Vijayan. The Education Minister Shree C Ravindranath and the Finance Minister Mr. T M Thomas Issac was also present during the scheme launch. The occasion of launch was the 60th anniversary of the very first state assembly session held in Kerala at this same place.

Students can register online through the web portal – http://elrs.kerala.gov.in. This online registration portal is developed, supervised and maintained by the Dept. of Finance, Govt. of Kerala. The student’s registration to this portal has started from 5th Aug, 2017. The last date to register for this scheme is 31st Dec, 2017.

Key Features

- This scheme has been launched for the assistance of those students who are residents of this state only and have taken up some technical or professional degree. This is because these courses like B. Tech, M.C.A, etc. have higher semester fees compared to other general courses.

- This scheme is strictly not a loan weaver scheme about which there is still some confusion among students. The govt. will only help to reduce the financial burden which comes right after the completion of such above mentioned courses.

- For any education loan in India, most nationalized banks and financial institutions provide a window of 1 year which is also termed as repayment holiday. The govt. will extend this window to 4 years for those students who have registered under the scheme.

- As per recent survey, most of the banks in Kerala are suffering from bad debts. This is nothing but those loans, most of them are educational loans, which have become NPAs after regular defaults in loan repayment.

- As per a recent study made by one banking authority, the banks in Kerala has a total of Rs. 10,220 crore as pending education loans. Out of this, more than Rs. 1,315 crore in total has been declared as NPAs as there was a repayment irregularity/ default for a period, more than 90 days post the repayment holiday window.

- This scheme will also help in reducing the number of instances where the banks often bypass these NPAs or bad loans to third party agencies known as ARCs. These ARCs then charge a higher interest rate from the students. This situation is far more dangerous for the economically backward families.

Categorized Loan Account

The Govt. has divided the repayment assistance mechanism into four major categories which are explained below:

Category 1 – Education loans which are still standard assets of the bank as on 31st March, 2016 and not declared as NPAs yet. Under this category, the govt. will contribute to the loan repayment in certain ratio depending on the ongoing year of loan repayment. In the first year, 90 % of the amount to be paid will be borne by the Govt. In the next subsequent years, this share by the govt. will reduce to 75 %, 50 % and 25 %, up to the 4th year.

Category 2(a) – For the education loans up to Rs. 4 lakh declared as NPAs on or before 31st March, 2016 the beneficiary will have to contribute 40 % of the total amount due. The rest 60 % will be the Government’s contribution.

Category 2(b) – For the declared NPAs as on 31st March, 2016 with outstanding due of Rs. 4 lakh – Rs. 9 lakh, 50 % of the principal amount will be contributed by the state government and the rest half will be the student’s share.

Category 3 – The Govt. will weave off the total outstanding amount of loan for those students who have suffered from physical disability with more than 80 %, due to some accident or suffering from mental illness or even death during their loan period.

Eligibility Rules

- Education loan taken to pursue only professional / technical courses which are provide by the recognized colleges, universities and institutes will be taken into consideration under this scheme.

- The mode of admission to that course / degree should be totally in normal mode. Those students who have taken admission under NRI or management quotas are not eligible. Also education loans for studying abroad, is excluded from the scheme. However, only those students who got management quota seats in Nursing courses will be taken into consideration.

- The students who are permanent residents of Kerala are only eligible and the registration records along with the KYC information must be similar to the records of the loan providing bank.

- Educational loans taken from any nationalized commercial bank, Gramin Banks or any of the co-operative banks of Kerala will be deemed eligible under this scheme.

- The annual income of the student’s family should be not more than Rs. 6 lakh. However, for physically disabled students and also for those students who have expired after date of loan sanction, the upper limit of family’s annual income is Rs. 9 lakh.

- If the student is employed then his / her annual income should not be more than 1/4th of the annual loan repayment amount.

Documents

- The online registration for this scheme requires scanned copy documents such as – Matriculation Pass certificate, Aadhar card, PAN card. The scanned copies are to be uploaded in PDF format. In case of death or 80 % disability, the co-borrower’s PAN card and Aadhar card copy is essential.

- A certificate of eligibility which will also include proof of residence which is issued by the Village / Panchayat officer and is counter signed by any gazette officer is to be provided in a specific format.

- For deceased category, Death Certificate is to be provided. And the candidates with more than 40 % disability, proper Disability certificate is required.

- A certificate of course completion issued by the educational institute is mandatory. In case, the student left the course due to some medical issues or certain unavoidable circumstances, then the certificate should clearly mention the reason of course discontinuation.

- The annual salary statement of those candidates who are employed is to be provided. Those who are unemployed will have to produce the family income certificate.

How to get education loan subsidy application form?

Those who are eligible for this loan repayment scheme should visit the online web portal opened recently i.e. http://elrs.kerala.gov.in/. Here one will get the student’s registration form where all details along with scanned copies of the required documents are to be uploaded. This registration form is to be submitted within the last date i.e. 31st Oct, 2017.

How to Register in the Kerala Loan Scheme?

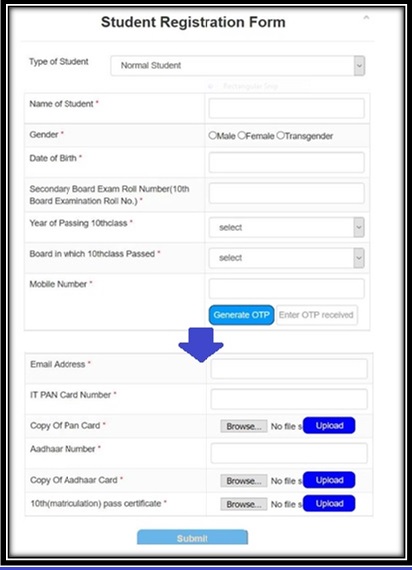

- To register for this scheme, please visit the online portal – http://elrs.kerala.gov.in/ and proceed with the “Student Registration” section provided in the home page.

- Select the type of student i.e. whether normal category, deceased student, disability with 40 – 80 % or disability with more than 80 %.

- Enter personal details like full name, gender, DOB, e-mail address, mobile number, Class 10 roll number, Year of passing Class 10, Class 10 passing Board, PAN, Aadhar number, etc. When providing the mobile number, click on ‘Generate OTP’ by which one OTP will be received at your mobile. Provide the same and proceed further.

- Upload the scanned copies of Aadhar card, PAN card and Matriculation pass certificate in PDF format in the specified sections. Then recheck the application form and proceed with “Submit” button.

- After successful registration, the registration details along with Login ID and Password will be sent to the registered mobile through SMS and to the e-mail address. Log in to the portal using the credentials to fill up the claim form of the scheme.

- In case the candidate is deceased or is suffering from physical disability of more than 80 per cent, then full details of the co-borrower which is in most cases the parents or legal guardian is to be filled up. Aadhar and PAN details are necessary here.

- Provide the details of course like mode of admission, date of course start, date of completion of the course, details of the educational institution, etc.

- Fill up the educational loan details such as name of bank, loan start date, amount which is paid, amount which is due and select the category of scheme assistance applying for.

Budget 2017

The Kerala govt. has introduced this scheme for those education loans taken after the start of the financial year 2016 – 2017. The total corpus allocated for this scheme is Rs. 900 crore. As per reports from the Finance Department, almost Rs. 600 crore will be utilized this year only.

Other Articles